Most of us sacrifice and save for four decades in preparation for what we hope will be a comfortable retirement. We are laser-focused during our working years on accumulating as much as possible, and by the time we retire, many of us have refined the art of wealth accumulation in our IRAs, 401(k)s, and a variety of other investment accounts. We feel pretty confident in our retirement preparation and then something happens that shatters our confidence…we retire. We quickly come to the realization that successfully investing and managing the distribution part of retirement takes a completely different skill set than accumulating money in retirement accounts.

Besides the universal question of how to invest, there are questions regarding distributions, taxes, risk, and keeping our income up with inflation that will all have to be addressed as we transition from accumulating to distributing our retirement accounts. All these questions bleed into the single, overarching question that every retiree needs to figure out: How am I going to create an inflation-adjusted stream of income from my investments that will last for the rest of my life?

The Need for a Retirement Income Plan

The quality of the next 30 years of your life is dependent upon the decisions that you make at retirement and the plan you put in place. There is so much on the line, and mistakes made at the beginning of retirement are not forgiving. There are no do-overs. A well-thought-out retirement income plan will provide discipline, order, safety, and peace of mind. A sound retirement income plan will allow you to focus on your retirement dreams and not be obsessed with the daily movement of markets, interest rates, or how current events will impact your retirement.

A retirement income plan should be unique to you and your specific needs. So, copying your retired neighbor’s retirement income plan won’t work. Following some generic, “rule of thumb” withdrawal advice from your financial advisor won’t get it done, and buying an annuity that will never keep up with inflation over a long retirement will only serve to crush your future purchasing power. And finally, decades of investing have already taught you the futility of market timing and betting your future on guessing the direction of the stock market.

Now that I have shot down all the popular attempts to create retirement income streams, and before I show you how a professional retirement income plan is created, let’s address what it is that we need a retirement income plan to do.

A Successful Retirement Income Plan Must Address Five Objectives

- It must be goal specific.

- It must create a framework for investing.

- It must create a framework for distributing.

- It must create a framework to reduce risk.

- It must create a framework for reducing taxes.

Goal Specific

A retirement income plan that is goal-driven provides detailed objectives. It is a date-specific, dollar-specific blueprint that will guide you throughout retirement. A date-specific, dollar-specific plan defines how much income will be needed during retirement, and when it will be needed. Its objective is to deliver future income to the retiree with the least amount of risk, after all risks have been considered. A properly structured retirement income plan matches your current investment strategy with your future income needs. Like any goal-driven program, the performance toward reaching the goal must be monitored to maintain discipline and allow for adjustments if the goal is to be realized.

Create a Framework for Investing

Retirees must find the proper investment mix of low-volatility fixed-income investments and higher-yielding, more volatile equities.

Fixed-income investments such as bank deposits and certain types of bonds can provide a haven to draw income from when the stock market takes its occasional dive. As valuable as these types of investments can be in the short term, they are a long-term liability that will never keep up with inflation.

On the flip side, retirees need to own some equities in their portfolios. Owning higher yielding equities is a logical way to keep ahead of inflation over the long run. But we all know that short-term volatility and unpredictability afflict all who own equities. Creating a retirement income plan that takes advantage of the opposing nature of fixed-income and equities is an essential component in creating a long-lasting retirement income plan.

It’s just commonsense to invest the money we’ll need in the short-term into fixed-income type investments and invest the money we don’t think we will need for a while into stock-related investments. But, most retirees and their advisors don’t invest this way. Unfortunately, the failed practices of chasing last year’s returns and making investment decisions based upon guessing the future direction of the stock market continue to be the prevalent methods used to determine investment allocations, even though these methods have proven to be extremely unreliable.

Following a plan that allocates retirement savings by determining short versus long-term income needs liberates the retiree from having to time the markets or beat the stock market average by superior investment selection. With an investment plan that matches current investments with future income needs, the retiree only needs to concentrate on maintaining discipline and following the plan.

Create a Framework for Distributing

When it comes to withdrawals from investments at retirement, I have noticed two types of personality traits. The first trait is manifested in individuals I will call the “entitled spenders” who think to themselves, “I have been saving all my life for retirement, and I am now retired, so I am going to spend however much I want on whatever I want.” The second type I will call the “paranoid savers”. These people are those who think, “I may have a lot of money, but it has to last a long time. And who knows what the future might bring?” These types of individuals are often afraid of spending any of their retirement funds at all.

The “entitled spenders” sabotage their retirement by spending too much, too early, as they burn through all their retirement savings in the first ten years of possibly a thirty year retirement. The “paranoid savers” likewise harm their retirement by living below their privilege by denying themselves many of the simple pleasures and opportunities of retirement. Ironically, both the spenders and the savers would greatly benefit from the same date-specific, dollar-specific retirement income plan, a plan that outlines how much money can and should be withdrawn from investment accounts and when.

Quite literally, the million dollar question is, “How much can/should I withdraw from my investments each year?” You must be able to answer this question if you’re going to have a sustainable income stream throughout retirement, and if you’re going to be able to enjoy your retirement experience to the fullest.

A sustainable withdrawal rate can be created through determining the answers to three important questions:

- How much income will I need to pull from my investments to sustain my retirement lifestyle?

- When will retirement savings need to be converted into retirement income?

- How should retirement accounts be invested until they are needed to be converted into income?

Again, having a retirement income plan that includes date-and-dollar specifics should drive your withdrawal decisions. Adjustments in either the timing of withdrawals, the withdrawal amounts, or how retirement funds are invested between now and the future income date will impact your future income stream.

Create a Framework to Reduce Risk

A viable retirement income plan must recognize and minimize risks where possible. Retirees are particularly susceptible to three kinds of risks:

- Inflation risk

- Stock market risk

- Behavioral risk

Inflation Risk

When it comes to inflation, you must ask yourself the following, “How do I invest to maintain my purchasing power and stay ahead of inflation?”

Inflation is the gradual but lethal loss of purchasing power. Currently, we are going through a period of high inflation but historically, the long-term inflation rate has averaged 3%. At just a 3% inflation rate, $1.00 will only be able to purchase $0.41 worth of goods and services at the end of a 30-year retirement. Unless you are willing to reduce your lifestyle and spending habits by about 60% during your retirement, inflation must be dealt with. Fortunately, the risk of inflation can be mitigated by investing in inflation-beating equities. The retirement income plan I will show you later in this blog helps by deliberately designating a portion of a portfolio toward long-term inflation protection.

Stock Market Risk

How do I maintain investment discipline throughout retirement and not make major mistakes during periods of market volatility? Market corrections are part of the investment cycle and should be planned for. Successful investors follow plans and are patient, while unsuccessful investors follow the breaking news and daily movements of the stock market and are prone to panic. Informed investors manage stock market risk by being diversified and patient because they understand every bear market is eventually followed by a bull market. Having a plan in place is the antidote to panic. Knowing what you own, and why you own it, goes a long way towards helping you stay the course during periods of market turbulence.

Behavioral Risk

Two related questions come to mind when considering the behavioral aspects of a retirement income plan:

- How do I protect myself from my older self when my financial judgement is clouded by age?

- How do I provide the less financially savvy spouse with a plan to follow that will provide for his or her financial needs after my death?

Retirement is not a time for investment experimentation. It’s not a time to be tossed about by every headline on the nightly news or story on the internet. It isn’t a time to change your investments based on irrational exuberance or equally irrational fear. A goal-specific income plan goes a long way toward helping to navigate the emotional roller coaster of investment management now, and especially as you age. It can also be a valuable tool to provide guidance to a spouse upon your death. A date-specific, dollar-specific retirement income plan helps protect your future from perhaps its greatest threat — you.

Create a Framework for Reducing Taxes

From which accounts, or combination of accounts, should I withdraw retirement income from to give myself the most tax-efficient income stream? Should I withdraw from my IRA, my Roth IRA, or my non-retirement accounts? How do I go about managing my Required Minimum Distributions?

Tax-saving opportunities rarely happen by accident. Rather, they come about through careful planning. This is especially true with retirees. Keeping retirees in lower tax brackets throughout retirement can be done by managing withdrawals from pre-tax versus after-tax investment accounts. In other words, the retiree can take income from IRA accounts until they reach the top of a tax-bracket and then take the balance of their needed income for the year from an after-tax account. This is an easy concept to visualize but a little more difficult to implement. What adds to the complexity is that implementing this plan has to integrate with the framework for investing and the framework for distribution sections that I just mentioned. At this point, it might sound daunting to bring all of this together. As we create the income plan in the next section, you will be able to see how all these components can integrate with each other.

Retirement Income Plan Creation

Now that I have explained the retirement income challenge, and what your retirement income plan must address, let me demonstrate how a professional retirement income plan is structured. In 2007, we created our proprietary retirement income plan that we call the Perennial Income Model™. It has helped hundreds of retired families successfully navigate their retirements during the volatile years since its inception. The Perennial Income Model is goal-based and creates the essential frameworks for investing, distributing, reducing risk, and reducing taxation, as previously mentioned.

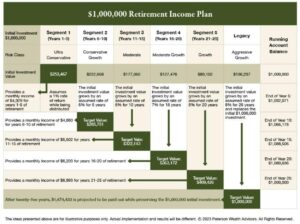

Allow me to introduce the Lee family who we will build a retirement income plan for. Tony and Kathy Lee are both 65 and are ready to retire. They have accumulated $1,000,000 in their 401(k) and their after-tax brokerage accounts. They want to know how they should invest the million dollars and how much income they should expect to receive from that sum of money. They feel a retirement income plan spanning 25 years should be sufficient, and they would like to pass the full $1,000,000 to their children upon their deaths, if possible.

When it comes to making investment decisions, the most important consideration is an investment’s time horizon. In other words, how long will the money be invested? The Perennial Income Model matches the Lee’s current investment portfolio with their future income needs by dividing their money into various investments that have different objectives based upon when a particular segment of their money will be called upon to provide future income. Therefore, the Perennial Income Model will divide the $1,000,000 they have accumulated for retirement into six different accounts. The first five of these accounts are responsible for creating retirement income for five different five-year periods of the Lee family’s retirement. I will refer to the accounts that cover the five-year period of income as segments. So, Segment 1 is responsible for providing the income for the first 5 years of retirement, Segment 2 for years 6-10 of retirement, Segment 3 for years 11-15 of retirement, and so on… until 25 years of retirement are covered.

The sixth segment, or Legacy Segment, is designed to create a fund that will replace the original investment of $1,000,000 to the Lee family at the end of 25 years. This provides money for their heirs or can serve as an insurance policy should they live longer than 25 years or experience large end-of-life expenses like nursing home costs. The accompanying chart shows the retirement income plan being built for the Lee family — I will walk you through it to make sure it all makes sense to you.

The Perennial Income Model Walk-Through

The underlying principle of the Perennial Income Model is matching current investment portfolios with future income needs. Therefore, the money that the Lee’s depend on to provide income in the short-term is invested in conservative investments that provide safety from volatile markets. The money that won’t be needed to create income for a prolonged period is invested into more aggressive investments that keep up with inflation. Segment 1 will provide income for the first five years of retirement. It will be invested into a conservative account that will systematically distribute $4,329 monthly to the Lee’s checking account.

Segment 1’s primary responsibility is safety of principle because it’s sending out a monthly payment immediately; so, this segment is the most conservatively invested. We assume only a 1% rate of return on the money invested in Segment 1. Certainly, in today’s environment retirees can, and should, expect a higher return than 1% on their conservative money. We also expect to outperform the conservative assumptions for the other segments as well. By choosing to underestimate performance, we avoid creating a false sense of security and unrealistic income expectations. Obviously, if the Perennial Income Model works with the conservative assumptions we are using, it will work better as investment performance exceeds these assumptions.

Segment 2 will take over the role of providing monthly income to the Lees once Segment 1 runs out of money at the end of the fifth year. Since the money from Segment 2 will not be needed for at least five years, it can be more aggressively invested than Segment 1, but it can’t be significantly more aggressive. A prolonged bear market could last longer than five years, so the bulk of this money should also avoid volatile investments. That’s why only a 5% return is assumed during the five years it’s invested before being turned into income in year 6.

Segment 3 will be invested for ten years before it will be called upon to create income for years 11-15. Because the money in this segment won’t be used for ten years, Segment 3 is moderately invested in a 50% stock/50% bond portfolio. A conservative 6% return is assumed for this segment.

You can see from the chart, Segment 4 assumes a 7% growth rate and Segment 5 and the Legacy Segment assumes an 8% growth rate. We use these higher growth assumptions because these segments are more aggressively invested. Investments that will not be needed for fifteen years and beyond must invest into a diversified portfolio of equities to keep up these higher growth assumptions. History has shown us that, in the long run, equities have always beaten inflation and have given us superior returns. It’s understood these inflation-fighting segments will experience occasional bouts of volatility that the stock market imposes with regularity. But given the long-term nature of these segments, short-term volatility is inconsequential. The key to making the stock market work for you is to maintain discipline and stay invested during periods of volatility. Following the Perennial Income Model will provide the discipline that is needed.

Harvesting

At first glance, the Perennial Income Model appears to become more aggressively invested as the retiree ages and gets into the latter segments of the plan. Having 80–90-year-old retirees with all their money invested in long-term, aggressive equity portfolios doesn’t make any sense. Fortunately, this is not how this retirement income plan works when the income model is properly managed and “harvested.” In financial terms, the process of harvesting is transferring riskier, more volatile investments into a conservative and less volatile portfolio once the target, or goal, of each segment is realized. The target, or goal of each segment is the number found in the dark green box associated with each segment.

For an example of harvesting, let’s look at Segment 4. You can see that the initial investment in Segment 4 is $127,476 and we know that if this initial investment grows by the assumed growth rate of 7%, it will reach its target, or goal amount by the projected fifteenth year. Segment 4 is invested in a moderate growth portfolio (70% stocks, 30% bonds). According to a study done by Vanguard, the historical return of a moderate growth portfolio has averaged an annualized return of 9.4% since 1926. So, it would be plausible, if history simply repeated itself, that the investment portfolio in Segment 4 would reach its goal of $363,172 before year 15 (at a 9% growth rate, the segment reaches its target in 12 years). Once the target is reached, no matter what year that happens, the investment needs to be harvested and preserved. That means the equities in the segment that have reached their target goal must be moved into more stable and conservative investments.

We have found, the key to successful outcomes is to begin with conservative growth assumptions and then maintain the discipline to harvest portfolios in the segments when they reach their targets.

Five Insights to Point Out:

- Notice the account balance stays roughly the same throughout retirement (see the far-right column of the chart). People often assume that as segments are liquidated, the overall portfolio balance is going down, but that’s not the case. Recall that as the early segments are being liquidated, the later segments are invested and growing.

- Notice that the retirement income plan is projected to automatically increase the Lee’s income every fifth year by an annualized 2.6% rate to help offset the effects of inflation.

- To keep things simple and to help you to understand how the Perennial Income Model works, I have not incorporated any other sources of income such as Social Security or pensions into our example. But, for tax planning purposes, projected Social Security, pension, and other sources of taxable income should be incorporated into the retirement income stream projections. Once the income stream is created by adding all sources of income, thoughtful consideration should be made to determine which type of account (IRA, Roth IRA or after-tax account) should be allocated into the various segments for maximum tax efficiency.

- Assumed growth rates are purposefully overly conservative. Historically, the S&P 500 has averaged more than 10%, and the largest assumed growth rate used in the most aggressive segment is only 8%. If you feel that these assumed growth rates are not realistic, you can always adjust the income plan to run at lower or higher growth assumptions. The Perennial Income Model uses conservative growth assumptions within the retirement income plan in hopes that the target for each segment is reached prior to the date it’s needed to provide income.

- Please look at the bottom line of the chart. Based upon these conservative assumptions, the Lee family will receive $1,674,433 of income during their 25-year retirement and leave $1,000,000 to their heirs.

Conclusion

I end with the question that all new retirees and those approaching retirement need to ask themselves, “Will I outlive my money, or will my money outlive me?” Without knowing anything about your finances, I can tell you that you will be much more likely to have your money outlast you if you follow a plan. Your retirement income plan should be goal-based and should serve as a guide to your financial decision-making for the rest of your life. It should drive your investments, withdrawals, and even influence your spending and gifting decisions.

The Perennial Income Model appeals to those seeking a logical, goal-based roadmap for investment management during retirement. It reduces the retirees’ need to be anchored to the daily movements of the stock market which, in turn, will provide them with greater peace of mind and will make them less vulnerable to making the irrecoverable investment mistakes that so many retirees make.

Retirees that follow the Perennial Income Model understand why they are invested, when they will need a specific portion of their investments to provide future income, how much they can safely withdraw, and how their dollars will need to be invested to accomplish their goals. They will also realize a more tax-friendly way to navigate retirement. The Perennial Income Model is designed to provide a secure stream of income in the short-term, while providing an inflation-adjusted stream of income for the retiree’s future.

Hopefully, you can now see that there is so much more to planning retirement income streams than buying an annuity and more to consider than following generic and overly simplistic rule of thumb guidelines to manage your finances during retirement.

My hope is that this blog has opened your eyes to a better way to invest during retirement and that you might be able to incorporate some of the ideas found in this blog so you might face your financial future with confidence and have the peace of mind to free you to pursue your retirement dreams.

The Perennial Income Model is explained in greater detail in my book “Plan On Living”. You can get a complimentary copy of my book and get a better understanding of the services that we offer by visiting here.