Executive Summary

Scott M. Peterson, Founder and CEO of Peterson Wealth Advisors, leads ‘How Does the Perennial Income Model™ Offer you Protection’. Scott is joined by Jeff Lindsay, Partner and Senior Advisor, along with four other advisors from Peterson Wealth including Daniel Ruske, Carson Johnson, Austin Lee, and Josh Glenn. As a team, they cover how The Perennial Income Model protects our clients as it provides a framework for them to follow, acts as a behavior modifier, serves as a guardian, can be a bad luck insurance policy, and identifies tax-saving opportunities. Follow along with the transcript below.

The Perennial Income Model™ for Retirement: Welcome to the Webinar (0:00)

Scott Peterson: Well welcome, my name is Scott Peterson. I’m the managing partner of Peterson Wealth Advisors. It’s good to have all of you with us today. We appreciate the time that you’re willing to spend with us today.

I know we have a mixture of existing clients who are familiar with the Perennial Income Model™ as well as some non-clients that are wondering what this presentation is all about.

I can promise both the client as well as the non-client that you’ll all benefit from this presentation. Clients will be reminded of how their money is being invested and how the income is actually being created to support them in retirement.

And our non-clients will be introduced to a unique program, our proprietary retirement income plan we call the Perennial Income Model. It could possibly change the way you look at retirement and it’s a plan which could really enhance your retirement experience.

This webinar has been advertised as how the Perennial Income Model can protect you in the down market. It should have been advertised “How Does the Perennial Income Model Offer you Protection?” I wish to apologize to those who are attending this webinar thinking that we can show you how to never lose money in a down market.

To be clear, we’re not suggesting that your investments will be less susceptible to market fluctuations than if they weren’t in the PIM (Perennial Income Model). Okay, that’s not the kind of claim that we or anybody else can make, nevertheless the Perennial Income Model still offers a lot of protection in a lot of different ways and we’ll share those with you today.

The Perennial Income Model provides investing guidelines, distribution guidelines, and guidelines to assist in reducing taxes throughout retirement. That’s the kind of protection that we’ll be talking about.

So we also advertised this webinar to be hosted by Jeff Lindsay and myself. And as Jeff and I talked we thought it’d be a lot more interesting if we had more participants, so we’ve decided to have some of our colleagues join us in hopes that’ll make it a little bit more exciting.

We have a great team of advisors here and I want you to get to know all of them. So Jeff and I will be the only advisors on the Q&A at the end of the webinar.

A Plan for a Successful Retirement (3:10)

Okay, so retirees need to have a financial plan to follow in order to have a successful retirement. I really believe that this is true. We recognize that most retirees are going through retirement without having any type of formal plan at all. There’s no plan to create and maintain their retirement income.

Working without a plan is dangerous. And without a plan, fear and greed become our greatest influence. And emotionally driven investment decisions will never produce a good outcome. So you need a plan that is designed to address your family’s specific needs.

But before we go any further, I want to talk about what a plan isn’t – a product – because there’s a lot of that out there these days. And buying a product is not a substitute for a plan, okay.

Annuities: An expensive substitute for a retirement plan

Many of you’ve been hit up about buying annuities. We find annuities are a very expensive substitute for having a plan. They never keep up with inflation, they lock your money up for years, and they pay some of the highest commissions in the investment world.

The second thing that we find is a rule of thumb guidelines that are out there. Rule of thumb guidelines lacks specifics and may not address your individual income needs.

Retirement Rules-of-thumb: May not be the answer

There are unfortunately a lot of rule-of-thumb ideas that have been passed around for generations and are still with us today. Let me show a couple of them out there because I’m sure many of you have been exposed to this.

60/40 Rule: We have the 60/40 rule that you know if you put 60% of your money in stocks and 40% in bonds, well then you should be okay for retirement. Okay, well the 60/40 rule lacks specifics.

As far as when you should pull money out of stocks, when you should pull money out of bonds, how you should create your income. None of that’s available with the rule of thumb 60/40.

Withdraw 4%: We also have the rule of thumb withdrawal 4% per year guideline. Now it might work if you’re properly invested. Again, we’re lacking the specifics, you know, if all your money is sitting in an account that’s earning 3% and you’re pulling 4% out, well it’s obvious that you’re just going to lose money over your retirement and certainly not keep up with inflation.

Monte Carlo simulations: Another one of my favorite pet peeves is that of Monte Carlo simulations. So this is when you sit down with an advisor who says, well historically if you would have invested x amount of money this way and withdrawn x amount of money, you would have been successful x amount of the time, you know, 79% of the time.

Again, there’s no specifics, and it’s always looking in the past. If you would have done this, this is what it would have generated.

You know, you wouldn’t drive your car around town by looking exclusively through the rearview mirror. Why would you want to manage your investments that same way?

And then the last one that’s kind of more popular. It’s more accurate, but it’s kind of a scary way to live life, is using a guardrails suggestions.

Guardrails: a suggestion that you tie your withdrawal amounts from your retirement funds to the movement of the stock market Now, I can’t imagine basing my spending decisions throughout my retirement on the movements of the stock market.

And I can’t think of a worse way to spend retirement than feeling the need to watch the day-to-day movements of the stock market again to determine how much money I can spend.

I guess the point I’m trying to make is that the investment industry has not given the retiree any real good options when it comes to creating a stream of income to last throughout retirement.

The Perennial Income Model (6:53)

The Perennial Income Model, it’s not a product. It’s not a rule-of-thumb to follow and it certainly won’t require you to monitor every movement of the stock market.

It’s a methodology to follow that has been successfully designed to provide each of our clients with a tailor-made framework to follow to create the most reliable stream of inflation-adjusted income that’s designed to last throughout retirement.

The Perennial Income Model was born in 2007 and now provides income to hundreds of retired families across the United States. In the 16 years since its birth, this methodology has been tested and refined, and we think it should be the default method for generating income from almost all retirees.

So if you’re new to our webinars and have not had a chance to pick up your book, pick up our book Plan on Living. I want to direct you to our website when this webinar is over to get your complimentary copy. Therein you’ll find a more detailed description of the Perennial Income Model.

But for now, let me just give you a short history how the PIM came to be, which will in turn help you to understand how it works. Then we’ll demonstrate how the, excuse me, I keep using the word PIM, the Perennial Income Model helps us to protect our clients.

Okay, so I’ll give you a short history how this all happened. So prior to 2007, I was really frustrated with the whole investment process. I was managing money for a lot of retired families and they all depended upon me, and I recognized that the investment process was broken, this didn’t work.

So prior to 2007, I felt like I was expected to do the research and follow the right economists of which there’s thousands. Then accurately guess the future and invest my clients into the best investments and get them out of the markets at the right time.

Well, that’s a pretty impossible task. So after all, how do you successfully guess and invest in the future when unforeseen events such as pandemics and terrorist incidents get in the way?

Well, the simple answer is that you don’t. Investing by attempting to guess the future didn’t work out well in 2007 and I could tell you it doesn’t work out very well into 2023 either.

So I understood back then that the retiree had to have safe money to draw income from when the stock market dropped. But they also needed to be invested in stock-related investments, or in other words in equities, if they were going to keep up with inflation.

So it was a delicate balance. How do you strike that balance without having a well thought out plan? And as I looked around in 2007, no plan existed.

About this time, I came across a paper from a Nobel Prize-winning economist, William Sharp. He’s a Stanford guy, and in his paper, he introduced the concept of time segmented investing to provide retirement income.

So what he suggested that when a person retires, the retiree’s investment funds should be divided into 30 separate accounts. Each of these 30 accounts would then be responsible for providing income for a one-year period of time, each one year of a projected 30-year retirement.

So there’d be an account dedicated to providing income in year number one of retirement, a separate account dedicated to providing income of year number two of retirement, so on until 30 years’ worth of retirement would be covered.

So the value of such an approach of investing, it was obvious to me, you know money set aside to provide income in the first year retirement needed to be invested much differently than the money that you won’t need for 30 years.

So in my opinion, his relatively simple and straightforward academic approach to investment management for retirees beat all the market timing and future guessing of the markets methods that were used by myself and other advisors at that time.

Okay, so the money set aside in an account to provide income during the first year of retirement had to be absolutely safe and absolutely stable. That’s where you’re getting your monthly check from right?

So this money and year number one of retirement can be subject to market fluctuations. Neither fighting inflation or getting a large investment return is a concern of account number one, simply because of the shortness of its duration.

Safety and stability are paramount. First-year money should be held in ultra-conservative investments that are not subject to a lot of market volatility.

Now on the other end of the spectrum is the money that is designed to provide income during the 30th year of retirement. The objective of this account is to keep up with the erosion of purchasing due to the power due to inflation.

So the dollars within this account would have to be invested in inflation-fighting equities. Short-term volatility is expected but irrelevant in this account. This money won’t be needed for three decades. And speaking collectively, equities have never lost value and have always beaten inflation over time.

So the 30 separate accounts would be therefore started and being very conservatively invested and then they would get progressively more aggressive as the need for income from these accounts is pushed out over 20 and 30 years.

So by following this program of investing, the retiree’s short-term risk of markets volatility is dissolved and the long-term threat of inflation is managed.

Now as much as I like Dr. Sharp’s concept in theory, it wasn’t practical to implement. I certainly don’t want to create and manage 30 separate accounts for each of my clients. And my clients certainly didn’t want to have the mailman bring 30 separate statements in the mail as they watch their 30 separate accounts either.

So the hassle and the expense of this endeavor rendered this academically solid idea of time-segmenting retirement funds nearly impossible.

Okay, so not long after reading Sharp’s paper, I visited one of those Christmas tree farms where you cut down your own tree. Now at the tree farm, I walked by the saplings, I was with my children at the time, walked by the saplings, then the two-foot-tall trees and the various progressively larger pine trees until I arrived at the group of trees that had been prepared for people to harvest that year.

The smaller pine trees and their various stages of growth were there to provide future income for the Christmas tree farm. The Christmas tree farm had planned years in advance for his future income needs, and I thought at that time that the process of segmenting today’s investments to match future income needs is very similar to how this Christmas tree farm operates.

The farm had implemented a time-segmented approach of its own. And I remember thinking that day if the Christmas tree farm can figure this out, I should be able to do the same. There must be a way to transform the concept of time segmenting into a practical model of investment management.

So we went to work. And as I thought about this, I realized that all I really needed to do is to adjust the length of time for each account. If I change the time each account had to provide income, or from one year to five years.

So you see managing six accounts that provided income for a five-year segment of time versus the original one-year time frame was workable and followed the original objective that Sharp expressed.

So I therefore ended up with the accounts that covered the first five years of retirement. And a second account that covered years six through 10, and a third account that covered years 11 through 15, and so forth until we built this out over 30 years.

We call these five-year periods in our office, we call them segments. So once all the wrinkles of transitioning and academic idea into a workable methodology were ironed out, we launched our trademarked version of time segmentation, which we call the Perennial Income Model, or the PIM as I’ve been referring to.

So, let me share with you the Perennial Income Model again. This will be new to some of you but this is nice to go through it very quickly. And again, get our book, it will get into more details.

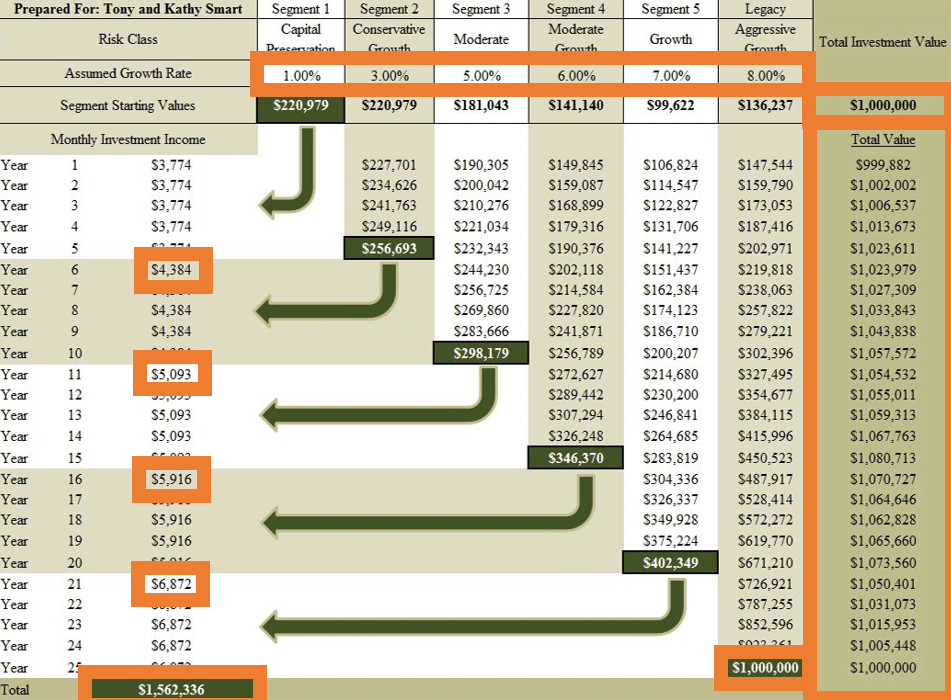

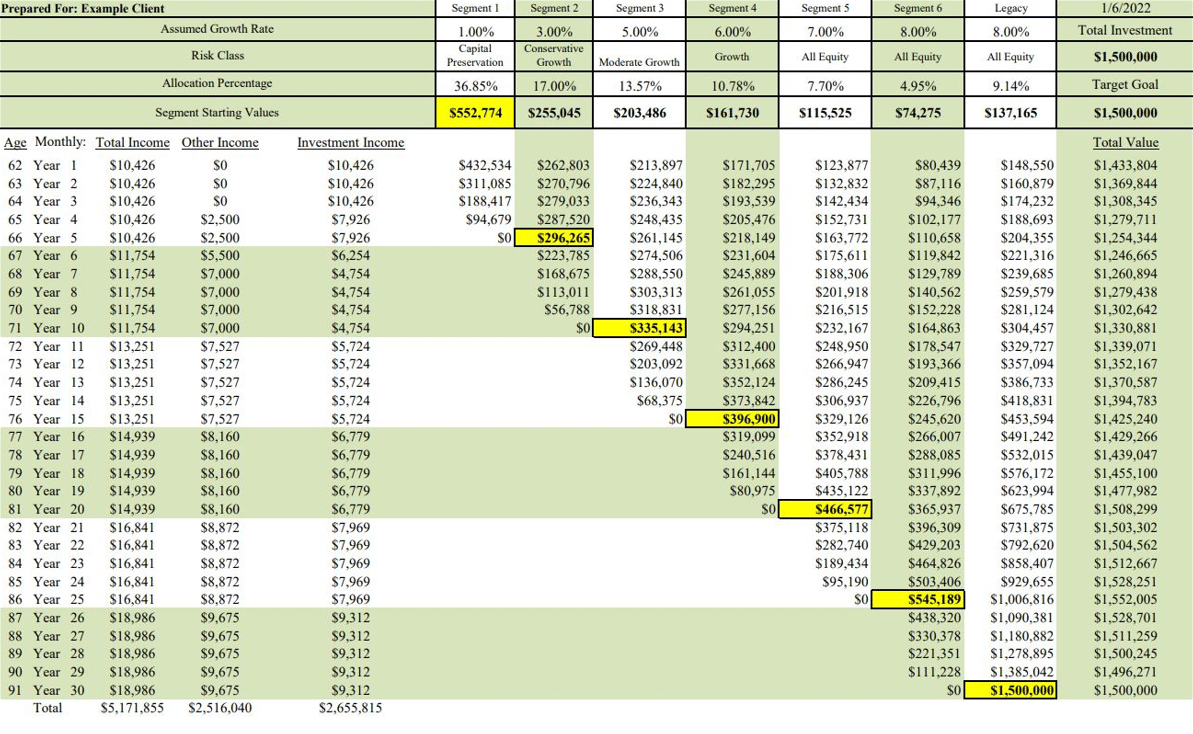

So here’s how it works out. You see that in the top right-hand corner, we’re starting with a million dollars. And in the bottom right hand, you see where the objective is to end with a million dollars, okay.

Also, this is just a 25-year period of time that we’re dealing with this for the sake of time and space, but anyway. So we’re going to divide the investment, the million-dollar investment portfolio into five different segments.

Each segment again is responsible for creating a five-year period of retirement. So segment one again, the first five years, segment two years six through 10, and so forth. Then we have a sixth segment that we call our Legacy segment.

The job of the Legacy segment is to basically start with, in this case, $136,000 as you see in that second to the, anyway on the right-hand side, not the second to the farthest right, that’s the Legacy segment.

Starting with $136,000 the objective through the miracle of compound interest is to have that grow to the original million dollars that we started with. Okay, so this is how it works.

I want you to notice a couple things though. Number one, we had to assume some kind of an interest rate. And you see we’re assuming very conservative interest rates.

Can you do better? I would hope so, we certainly do. But what good would be realized by using inflated numbers? You would only deceive yourself into taking higher income, but in the end, you’ll probably be disappointed.

So history tells us that these assumptions are very attainable. So if you disagree you can always choose more conservative assumptions in your own plan. But the idea is we want to underpromise and overperform.

And if you take a look at that, you know segment one, we’re showing a 1% interest rate. Well, we can get 4% in CDs right now. So obviously we can do better there. But I guess that the point I just want to make you understand is that we’re using very conservative assumptions.

Because we’re the only people that do this it’s not like I’m competing with the guy down the street, because I’m not, okay. So we just assume very conservative assumptions.

So number two, inflation-adjusted income stream. I want you to notice how this thing is built. Every five years you get a raise, okay, so an attempt to keep you up with inflation.

Okay, the total value column. You would think again that you’re in segment one, again we’re going to spend all of segment one which provides that income of $3,774. Okay, but that segment’s gone after five years.

Then you think segment two, we move on to that, where we start with $220,000. We’re going to have that grow just $256,000 and then we spend all of that in the second five-year period of time.

So you would think that the account value is going down, but in reality, as you can see, the account value, the total account value stays pretty stable because as we’re spending segment one and spending segment two, the other segments are growing for you.

And then its total distributions. Look at your total inflation-adjusted distribution during the 35 years. Okay, you see during the 20, yeah 30 years, I should say 25 years, excuse me.

You see you have $1,563,000 that has been distributed, and you still have the million dollars that you started with. That’s the objective.

Now people are going to ask, well can I pull more money out of this model? Well yes, certainly you would just leave less in the Legacy bucket.

So let’s transition over to the, let’s clean this up a little bit. I just want to tell you that when I teach education week every year, and when I show this slide at education week, this is when all the phones come out and the cameras come out, and they start taking pictures.

And I feel like sometimes, they think that well, here’s a secret formula all I have to do is get this and I could create this on my own spreadsheet at home.

Okay, I got that, but I want to warn you of something, that there is more to this than the spreadsheet. As I show you this, I feel somewhat like the negligent adult that hands the keys to a new sports car to a 16-year-old boy and says here, here it is, this is all you need.

So I just want to warn you even though you may be very adept at creating spreadsheets or you’re able to put together a plan following the pattern exactly that I’ve provided, please don’t think that you’re done. I would say quite to the contrary, you’ve just begun.

You see a time-segmented distribution plan takes a couple of hours maybe to create and it takes 30 years of discipline to successfully implement.

Those who create a spreadsheet invest and then forget about their investments or abandon the plan will not have a successful outcome. Okay, when investor discipline fails the plan will fail.

So the essential step of harvesting a time-segmented program is really where the rubber meets the road, not in the creation of the spreadsheet. So I feel obligated to kind of explain what harvesting is about.

Simply stated, the process of harvesting in financial terms is when we transfer riskier more volatile investments into a conservative and less volatile portfolio once the target or the goal of each segment is reached.

Okay, so this is a very goal-based program. And once you understand that when we hit our target amounts, that’s those numbers in green, every segment has a responsibility of providing income. So we let the money grow within the segment whenever we hit those target amounts. At that point in time, we want to take risk off the table and change the more aggressive investments into more conservative investments. We reduce risk.

Harvesting adds order and discipline to the investment process which results in better investment returns. Less risk and less selling based upon emotions. Without harvesting, the time segmentation model becomes more aggressively invested as a retiree ages and gets into the latter segments of the plan.

So having 80 and 90 year old’s, with their money all invested in long-term aggressive equities does not make any sense at all. Unfortunately, that’s not how the program works. If the time-segmented plan is properly monitored and harvested the process of monitoring and harvesting are imperative to the success of this time-segmented distribution plan.

I want you to think with me for a second when we talk about harvesting what’s happened over the last 10 years. You know, we’ve been busy harvesting our client’s segments as they reach their goal over the last 10 years because the markets have been very, very kind to us.

And I can tell you now that our clients are very happy that we’ve been harvesting along the way. We basically took the money out of the more risky things into less aggressive less risky things as we met our goals.

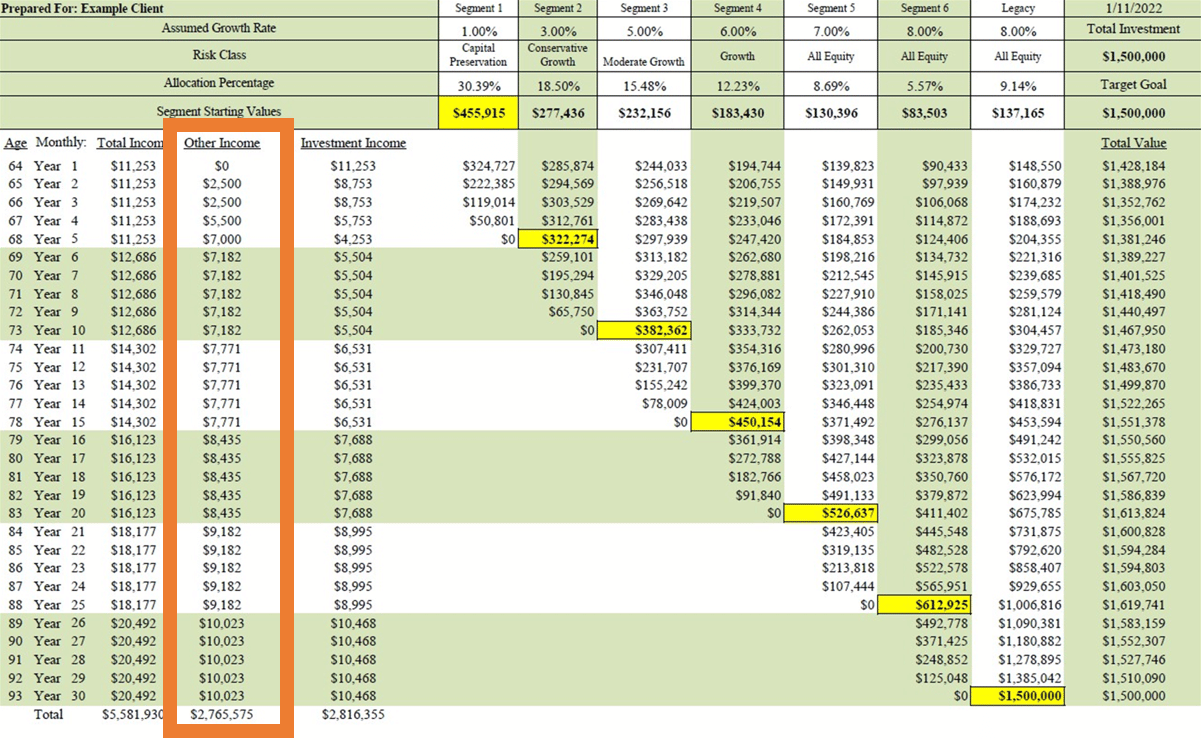

Okay, and then one last thing before I turn it over to the other guys here. Now that you understand the basics of the PIM, I want to show you a real-life example.

Okay, this version shows an actual model that we constructed for one of our clients about a year ago. It incorporates the client’s Social Security income and pension into the mix.

So this is by the way a 30-year retirement versus the 25 I was showing you before. But we allow the program to solve or maximize the way to get the most amount of income they possibly can, incorporating against Social Security, pensions, and so forth.

But I will tell you this, the Perennial Income Model truly has withstood the test of time. It’s goal based, it provides a framework for investing, a framework for distributing the right amount of money from the right accounts. It provides a framework to manage risk and as you’ll soon see it provides an excellent tool to assist us in organizing and implementing tax-saving strategies.

Now in 2007, the initial goal of the Perennial Income Model was to provide a logical format for investing in generating inflation-adjusted income from your investments throughout retirement.

As I just demonstrated, we accomplished this goal by projecting a retiree’s income over multiple decades. And in the beginning, we did not fully anticipate all the accompanying benefits that would result from projecting the right retiree’s income over such a long time frame.

There are unique planning opportunities that have manifested themselves and our eyes have been opened to a number of benefits that we could not have foreseen before creating and using the Perennial Income Model.

As we have projected income streams for our clients throughout their respective retirements, we have found that the Perennial Income Model satisfies many roles for our retirees that few systems or investment programs provide.

We want to share with you some of the advantages that we have seen and some of the ways that actually the Perennial Income Model helps to protect our clients.

And so anyway, let me turn the time over to Carson.

Provides a Retirement Framework to Follow (24:46)

Carson Johnson: Thank you Scott, let me just share my screen again.

All right, thank you Scott. So yeah, to support what Scott said, the Perennial Income Model does serve as a protection in many ways and helps provide a framework for our clients to follow.

And so the four points that I want to make here really quickly is to show the four different ways the Perennial Income model serves as a guide for our clients.

First, it helps our clients know the right amount of money that should be distributed from their investments. As it comes to a retirement plan, it’s not just the income that comes from investments that’s part of a retirement plan.

As Scott mentioned there’s Social Security, there’s pensions, there’s rental income, that’s part of this and so it’s just figuring out what is the right amount that should come from the investment portion that you’ve built up and saved over the years.

Second, it provides a guide in maximizing your tax-efficient stream of income. It’s a really important part as part of the retirement plan.

Third, it’s coordinating your Social Security benefits as well as your spousal Social Security benefits.

And then lastly, it’s managing inflation and volatility risk. Now we’re going to stay high level on a lot of these different points because there could be a webinar on every single one of these guides, but we’ll want to go into some of the main points as it pertains to these four ways that it serves as a guide.

So the first thing is that the Perennial Income Model offers flexibility. Now one of the most important considerations an advisor should be advising their clients on is to determine whether clients have sufficient funds to make major purchases or sustain a lifestyle.

Now I can’t go into all the details on how that is done perfectly because everybody’s lifestyle is different, and we know that life happens. And retirees don’t always follow a 30-year plan exactly.

Every scenario is different and whether you need to take a large lump sum distribution from your retirement plan, or have irregular income, or if you’re wanting to have more income in the earlier years of your retirement.

Whatever the situation may be, the Perennial Income Model helps map out how each scenario will impact your income. If you don’t have a plan, then you’re simply guessing and helping that it works out.

The second point is to maximize tax efficiency. So seeing your income presented through the Perennial Income Model allows us to tax by not for year one of retirement, but years one through 30, or one through 25, however long your retirement plan is with the goal of minimizing taxes throughout your retirement.

So the first couple of steps that we do in order to create this retirement plan is first, is to maximize income. And how we do that is about knowing how much money you can pull from your accounts and how that will impact your income.

The second step is to know what accounts to pull this money from to minimize taxes. Jeff will actually be talking in a little bit more detail about this later in the webinar to specifically answer the questions: how much we can pull from our accounts and what accounts to pull from when drafting and creating your retirement plan?

The next thing, I’d like to make this analogy, is related to a junk drawer. And I don’t know if any of you relate to this, but in my house, there is a drawer in my home that we refer to as the junk drawer which contains all sorts of different things in there.

It contains scissors, it has batteries, it has rulers, pens, pencils, etc. And it’s the place that you go to find really any random object, but it’s unorganized.

And oftentimes when clients come to us for help, they come to us with a junk drawer full of investments. Now, I don’t say that in a way that is mean, saying that their investment accounts or investments are bad in any way, but just simply that they come to us with an unorganized drawer of investments.

And sometimes just a little bit of help and organizing those investment accounts can make a big difference as it pertains to taxes. The Perennial Income Model positions a retiree’s plan in a way to organize their tax-deferred, tax-free, and non-retirement investment portfolios into a single tax-efficient stream of income that is designed to minimize taxes.

The creation of every individualized Perennial Income Model will be different because every person’s situation is different. But it’s the way we organize that Perennial Income Model that fits into each client’s situation that matters.

And as I mentioned before, Jeff will run through some examples with you later in the webinar about how to do this from a tax perspective.

Lastly, the Perennial Income Model serves as a guide for our Social Security claiming decisions. Social Security is one of the few sources of income that adjusts for inflation and is typically a major portion of a retiree’s income.

For these reasons, your decision to claim Social Security is so important and how it coordinates with not just your benefit, but also if you have a spouse, their benefit as well.

So many may be wondering, how do I maximize Social Security? Should I postpone my benefits until age 70? How do I coordinate my benefit with my spouse?

Generally, to start off with whether you claim earlier or later, the breakeven point, or at the point which those two points claiming earlier later collide is in your early 80s.

But there’s one lesson that is far more important when it comes to Social Security, which is it’s not just about maximizing Social Security, but it’s about maximizing your total retirement income.

So a few questions here to think about as we go through this webinar today. What income will you live off between claiming and taking your Social Security? Is it worth liquidating a part of your 401k or IRA accounts to maximize Social Security? Is there a difference in age between you and your spouse and how does your spouse’s benefit coordinate with your own?

As I mentioned before, every situation in case is different. But the Perennial Income Model allows us to focus on total income, not maximizing Social Security.

Also, just a little note similar to the timing of Social Security, those with a pension can determine if they have an option to take a lump sum rather than a monthly pension benefit, is also an important consideration, and figuring out how that impacts your total income.

Also, pension options that have survivorship options, meaning if something were to happen to you, that pension, how that continues on to a spouse also plays a role in your total income throughout retirement.

And so those are four ways that are guides that the Perennial Income Model serves for our clients.

And now I’ll turn the time over here to Josh to talk about the next benefit.

Acts as a Behavior Modifier (32:50)

Josh Glenn: Awesome, thanks Carson.

Well, I’ll tell you what. I’m excited to talk about how the Perennial Income Model is a behavior modifier.

One of the biggest reasons that I decided to come and work at Peterson Wealth Advisors was because of the way the Perennial Income Model helps our clients to be at ease and make smart investment decisions.

To start, I want to say something that may catch you off guard, and it’s this. In theory, investing is easy. You buy something at one price, when it goes up in value you sell it. You buy low and you sell high.

Now I know what you’re thinking, and you may be thinking something that my wife thinks a lot, Josh you’re wrong. But there are a few things that you can do to be a successful investor.

One of the most important things you can do is to match your short-term money needs with short-term less aggressive investments. And your long-term money needs with long-term more aggressive investments.

If you can do that, you can be a very successful investor. So if it’s so easy, why don’t we all just have money oozing out our ears? And that’s because actually implementing this type of strategy can be more difficult.

Here are a few common reasons it can be difficult. Misinformation, distractions, and perhaps the biggest one, our own emotions.

Our emotions can cause us to get in our own way and make bad investment decisions. As humans, we actually naturally tend to be bad investors.

In general, we’re short-sighted, prone to panic, and we have more biases than we’re often aware of.

One of the biggest biases we have is loss aversion. Studies show that the fear of losing is a much more powerful emotion within us than the satisfaction of gaining. And everyone’s probably experienced this.

So in other words, we’re going to feel almost twice as much pain when we lose a hundred dollars, then the joy we’re going to feel when we make a hundred dollars, or if we won a hundred dollars, kind of interesting.

And this bias predisposes all of us to be bad investors. One bad experience in the stock market which may be self-inflicted, maybe we caused that, maybe we made a bad decision, can cause someone to shun the explosive growth of the stock market over a lifetime.

There are millions of people who have missed out on the unbelievable market gains because of fear of seeing their accounts experience a temporary loss.

On the flip side, when investors recognize the reason they own a specific investment, when they understand how the investment fits into their overall financial plan, and when they understand when the specific investment will be needed to provide future income, investors can become quite rational.

When the crash of 2008 to 2009 occurred, about half of our clients were in the Perennial Income Model, and half weren’t. The investors who had date-specific, dollar-specific structure that the Perennial Income Model provided, they made better decisions than those who didn’t.

They didn’t panic, they knew that they were holding, they knew why they were holding the volatile investments that went down. And they also knew that they had the money they needed. They also knew the money they needed in the short term was invested in more stable less risky investments.

The therapeutic organization of the Perennial Income Model is extremely important. The decision not to sell during a future market decline may end up being the most important investment decision you will ever make. And the Perennial Income Model makes that decision easier.

Let me show you specifically how the Perennial Income Model can modify behavior.

We know that getting the needed return while taking on the least amount of risk possible is a pillar to successful investing.

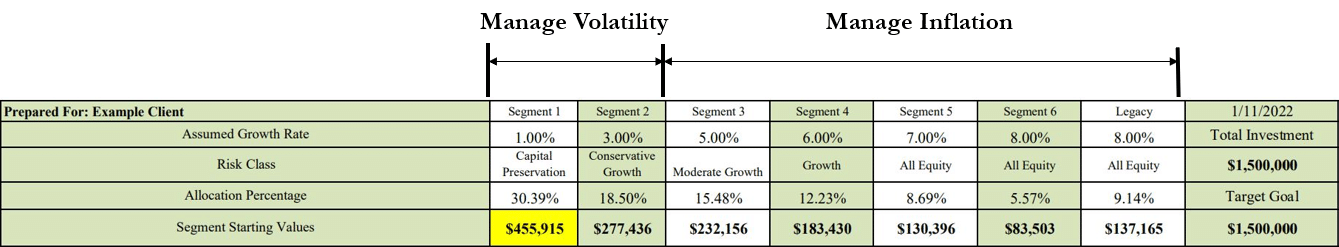

The two main types of risk that retirees face are volatility in the stock market and inflation. Volatility refers to the constant up and downshifts in the market. Inflation is the rising costs of goods and services which erodes your purchasing power.

If we assume a 3% inflation rate every year, a dollar’s worth of purchasing power today will only be worth 41 cents worth of goods or services 30 years from now. Kind of scary to think about.

These two risks are very prevalent to every retiree, but the Perennial Income Model helps solve both these risks. Let me show you how.

Using this example, we address volatility with the first two segments of the model by investing conservatively in short-term safer investments.

We understand that your short-term money can’t be going up and down with the daily fluctuations in the market.

If you had all your money invested in stocks when you are drawing income, it would be horrifying to be forced to sell your positions at extreme discounts because you need money for living expenses.

You can see here in segments 1 and 2, we are only assuming a 1% and 3% growth rate as this is your conservative money. When the market is down, the world tells you to sell your holdings and salvage your portfolio.

The Perennial Income Model tells you to hold your positions and wait out the market as your income needs are protected.

We address inflation, the other major concern for retirees with the latter segment of the model. You can see we are assuming much higher growth rates for these volatile equities, and that’s because they’re traditionally higher-yielding investments, and they can be inflation.

This is the only way to maintain your purchasing power over a 30-year retirement. While your loss of version bias may tell you to avoid investing in stock, the Perennial Income Model and history tell us that we need to invest in equities to beat inflation.

Now I’m going to turn the time over to our next presenter.

Serves as a Guardian (40:15)

Austin Lee: Thank you Josh, I really appreciate that. I’m excited to be here as well today to explain how the Perennial Income Model protects us and serves as a guardian as we move forward in retirement.

First, the Perennial Income Model serves as a guardian in a way to protect us from our older selves. Studies show, and from experience, we understand that as we age our cognitive abilities decline which significantly impacts our ability to make financial decisions.

Even though you may have gone through and endured many bear markets in the past and not allowed yourself to panic or give in to the pundits of the day, you’ve been able to stay away from making rational decisions, but that doesn’t mean you’d be able to do the same as you age if you’re not following a plan.

We’ve repeatedly seen cognitively sharp newly retired 65-year old’s morph into less confident slower to comprehend 80- and 90-year-olds. Sooner or later, it will happen to all of us in one degree or another unfortunately.

But it’s a valuable benefit to create a plan and understand that plan while you’re younger and you are mentally at the top of your game.

An even greater advantage to the Perennial Income Model is the knowledge that you’ll have a plan that will stick with you throughout the balance of your life as your cognitive abilities erode.

The next thing that’s important to understand is that the Perennial Income Model serves as a guardian when our loved ones pass away.

If you are a steward over your finances, the one in charge who takes care of the family, it is critically important that you answer the question:

How will my spouse make prudent financial decisions when I slip away from this life?

The Perennial Income Model can answer that.

It’s a cruel reality that when a surviving spouse inherits the money that they have important and critical financial decisions to make shortly thereafter. And it’s difficult because they have situational depression and it’s very difficult to get through every day.

An experience tells us that there’s more fraud that happens shortly after the passing away of a spouse than any other group. This makes them very vulnerable and susceptible to these kinds of things.

We know of families where they’ve bought a new motor home for $100,000 and shortly after the passing away of a spouse the surviving spouse has sold it for $19,000 dollars.

We hear of other stories where homes and cabins are sold for hundreds of thousands of dollars less than their actual value because the surviving spouse has panicked and is not sure if they’ll have the money to take care of their needs and continue living their life as they had before.

But when a loved one passes away there’s definitely a document or two that needs to be signed to transfer the accounts over into their name.

But the benefit of the Perennial Income Model is that the surviving spouse will follow the same plan that the couple’s followed for years.

Nothing changes and they’ll continue to receive the income inflation adjusted for the remainder of their life.

This again is a screen print of a Perennial Income Model, and one of the lessons that we’ve learned that’s most important during these vulnerable times is to have a plan. It is so vital to put something in place now to protect ourselves from our future selves and to make sure that our loved ones will be taken care of when we pass away.

What a blessing it is to know that as we cognitively decline, we’ll be taken care of and will have an income plan in place.

From our experience, it’s amazing and it’s interesting to sit down face-to-face with individuals and clients to implement this. You know as markets go up and down, as life circumstances change, a properly implemented and executed Perennial Income Model provides tremendous reassurance and indescribable peace of mind that our clients have a plan.

In any change of events or major events that happen in your life, you can rest assured that the Perennial Income Model can provide an inflation-adjusted income plan throughout retirement in the remainder of your life.

I’ll now pass the time over to Daniel who will continue to explain some of the benefits of the Perennial Income Model.

Bad Luck Insurance Policy (45:18)

Daniel Ruske: Great, thank you Austin. I’ll be talking about how the Perennial Income Model can be a bad luck insurance policy and how it protects the retiree from an episode of a bad sequence of return.

As we have already discussed, every stock market correction is temporary. However, that knowledge is only helpful if you are well positioned and able to select which investments to liquidate during a correction.

For example, let me tell you about Mike. Mike is 60 years old and has carefully planned for his anticipated retirement. He’s had a great career and saved a million dollars in his retirement accounts.

Mike understands that it’s important to invest some of his assets and equities to keep up with inflation, but also have a portion and bonds to predict him against being forced to sell stocks during the loss.

After doing a little research, Mike has decided to go with a 60/40 balanced mutual fund. What this means is Mike has his money in a fund that has 60% in stocks and 40% in bonds.

The day finally came and Mike’s retired. He started taking a monthly distribution from his mutual fund, and each month he simply sells a few shares of his mutual fund to support his monthly living.

Each one of these shares holds a portion of stock and portion of bonds. For the first few months, Mike is very pleased with his investment choice as the market was doing well. He was very comfortable liquidating a proportional amount of 60% stocks and 40% bonds for his needed monthly income.

Unfortunately, after just four months, his worst fears came to pass. The stock market dropped by 50%. Unlike during his working years, Mike couldn’t just wait for the stock market to recover, but he had to withdraw a portion of his money every month from his mutual fund just to pay the bills.

As Mike went through his monthly stipend, he realized that he was liquidating a proportional amount of stocks and bonds each month from his balanced mutual fund.

This meant that he was systematically selling stocks at a loss every month that the stock market remained down.

Now, Mike is not alone. This exact scenario happens and will continue to happen to millions of new retirees every time the stock market corrects itself.

It’s true when we are no longer contributing and we begin taking withdrawals from our accounts that the temporary up and down of the market can have a much bigger impact our investments than when we are working and had time to just wait out the market correction.

Now to be clear, Mike’s mistake was not in being too aggressively invested. A 60/40, or 60% stock 40% bond portfolio can be a very reasonable allocation for any retiree.

Mike’s mistake was failing to have a segmented income plan that allowed him to only liquidate the least impacted non-stop portion of his portfolio to provide his monthly needed income during the market downturn.

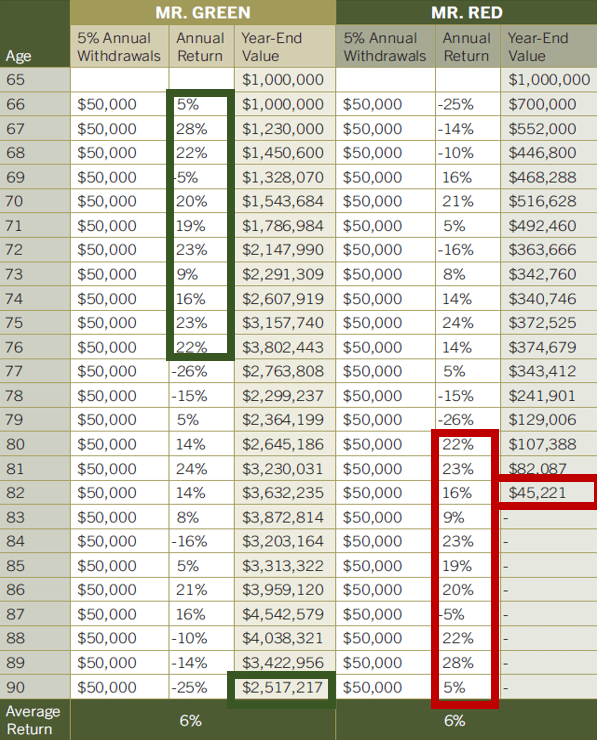

Now to further illustrate this point, I want to share with you another hypothetical example of two investors.

We have Mr. Green and Mr. Red, obviously green shirt, red shirt. They both retire, they’re the exact same age at 65. They both have saved up the exact same amount of a million dollars for retirement.

They both planned to take out the exact same 5% of their initial balance each year, which is $50,000. And over from their retirement over the next 25 years, they’re both going to average the exact same investment return of 6%.

The only difference between the two investors, is that Mr. Green experiences high returns toward the beginning of his retirement and Mr. Red experiences the same high returns, but toward the end of the 25-year retirement.

Though both average the same 6% return per year doing retirement, Mr. Green ends up with more than 2.5 million dollars to pass on to his heirs at death while Mr. Red runs out of money halfway through his retirement.

Every aspect of the retirement experience is identical except for the one thing, the sequence or the order of the investment returns.

Mr. Green experiences the positive returns at the beginning of his retirement and the string of negative returns toward the end. Mr. Red experiences the same thing exactly in reverse as shown.

Again, both investors average 6% over a 25-year retirement, but the sequence of returns is the only difference and we can see by the table just how big a difference the order of returns make.

The good news is that it is possible to set ourselves up to be successful no matter what the markets happen to do year by year. The Perennial Income Model is a bad luck insurance policy that can protect you from the pitfalls that Mr. Red experienced.

Now, as Scott said, we’re not suggesting that the Perennial Income Model will make it so your account balances never go down or never suffer temporarily, that will happen.

What we’re saying is that by following the Perennial Income Model, you would not be in a position to have to sell stocks at a loss during the next market correction.

Mr. Red’s losses are realized as he liquidates equities in the down years at a loss to cover his expenses. If Mr. Red were to have his portfolio organized according to the Perennial Income Model, he would not be in a position, we would have to liquidate those stocks and those years to provide income.

He would have a buffer of conservative investments to draw income from while giving the more aggressive part of the portfolio a chance to rebound when the stock market temporarily experiences the periods of turbulence.

The Perennial Income Model’s design is intended to give immediate income from safe low volatile investments and at the same time furnishes you with long-term inflation fighting equities and your portfolio, equities that will not be called upon to provide income for years down the road.

As you may remember, market corrections typically last for months, not many years. So even if you are the unluckiest person on the planet and your retirement coincides with the market crash, your long-term retirement plans will not be derived as long as you’re following the investment guidelines found within the Perennial Income Model.

Well now I’ll let Jeff take it from here.

Identifies Tax-Saving Opportunities (52:06)

Jeff Lindsay: Thank you, Daniel.

The Perennial Income Model helps us protect our clients by helping us identify tax savings opportunities.

It was Morgan Stanley who said you must pay taxes, but there is no law that says you got to leave a tip.

Tipping’s an interesting thing right now. I feel like I have to tip as a go through the drive through the Sodalicious, but we do draw the line at the IRS.

So we believe it’s the responsibility of every investor and every investment advisor to do all in their power to legally pay the least amount of taxes possible. Because every dollar saved in taxes can be used for another purpose that is important to you.

Retirees face a different mix of taxes and tax concerns than the non-retirees. So here are a few things that we have to think about for our retirees.

Required Minimum Distributions, it’s kind of this ticking time bomb that happens that it’s something that we have to, we’re going to have to pay taxes on at some point, so managing that correctly.

The potential of converting too much pre-tax dollars into a Roth IRA can create additional tax liability that we didn’t really need to have.

There are penalties on the Required Minimum Distribution if you don’t take out your Required Minimum Distribution that you should.

The IRS, or excuse me, Congress changed the rules on us a little bit this last year and move that penalty all the way down to 25%, it’s still significant.

Higher potential for higher Medicare premiums depending on how you work your income situation. Higher capital gains taxes, capital gains taxes are intertwined with the rest of your income and you could jump into a higher racket there.

Paying extra taxes on Social Security income, the calculation for what is taxable of your Social Security is quite complicated and also intermixed with the other different parts of your income.

So the Perennial Income Model facilitates good tax planning. Scott Peterson says, “We have found that by using the Perennial Income Model to plan and project future income streams, we can easily identify and organize tax-savings opportunities.”

But how does that work? The Perennial Income Model helps us to organize our income and our assets in a way that you can kind of see the whole picture all at once. You can map out your income from year to year that will allow you to forecast and plan for future years today. And it also protects a legacy so we can decide whether we want to pass on tax-free or taxable income onto our heirs.

There are a few strategies here that we can go over and opportunities that we have for retirees in managing our tax brackets. So, if you know what the tax brackets are, and you have different opportunities to take income from one source or another you can manage those brackets over time.

Qualified Charitable Distributions, we’ve talked a lot about those over the past while and if you, I won’t go into all the details about the Qualified Charitable Distributions now, but it’s a good opportunity to make charitable contributions without paying taxes on those distributions you make from your IRA.

Roth conversions are a great strategy if done at the right time and in the right situation. In some situations, Roth conversions make all the sense in the world and in other situations, it doesn’t make as much sense or getting too aggressive which Roth conversions can be a problem.

Managing Medicare premiums, this is definitely one that a lot of people, you haven’t really heard of it, and it could come back to bite you. Medicare premiums show up when you take too much income in any given year. But you don’t see the result of that until two years later.

So you start down on this what you think is a great strategy and then two years later all the sudden you have this jump in your Medicare’s premiums that you weren’t expecting.

And then the potential for tax-free Social Security income. If you manage your overall tax situation properly and your situation is just right, you can actually have a tax-free Social Security income there.

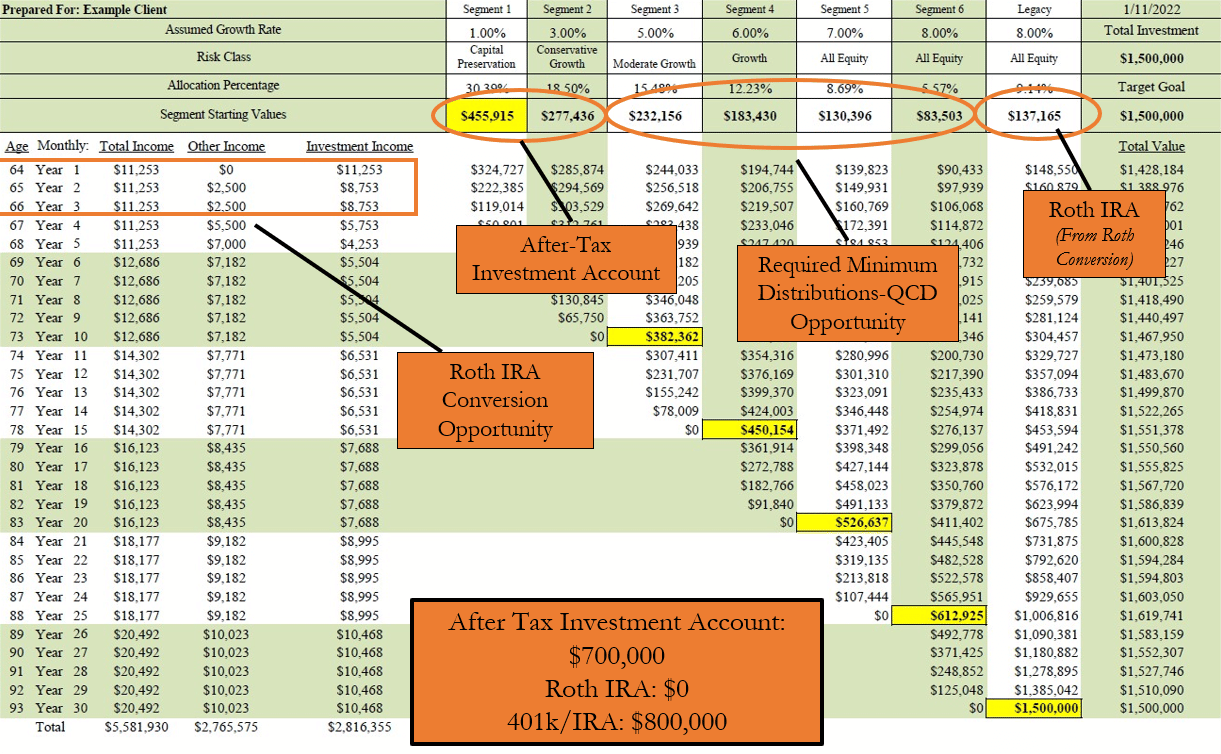

Let me go through if I could, just an overall situation. This is the same income model that we’ve been looking at throughout the presentation. But what I wanted to do is just show there’s several different opportunities that we have from a tax perspective looking at this.

This is a person who has $700,000 in non-IRA kind of investments and $800,000 in IRA investments. So you can see on the left side there, the overall income, the other income is low.

So this retiree, age starts at age 64, and you could make Roth IRA conversions for a few years. And if you’re even younger than 64 you may be able to make those Roth conversions a little bit higher before Medicare comes into play a 65.

So kind of timing that out in the right way, that opportunity you can see on the right side, the Legacy, we’re moving that money. It starts out as an IRA and then it can turn into a Roth IRA over time paying some taxes upfront.

Meanwhile, we’re taking out income from the non-IRA account for those first few years and not having to pay tax on both the Roth conversion and the IRA distributions as you go along.

The middle section shows Required Minimum Distributions. So if you manage the Roth conversion properly, you also have some IRA money left. If you haven’t converted your entire IRA, you have some of that IRA left to be able to make Roth, excuse me, to be able to make Required Minimum Distributions and use those Required Minimum Distributions to pay charitable contributions that you already were going to make anyway.

So these are just a few opportunities that we have and you can see being able to have the Perennial Income Model laid out in front of us gives us an opportunity to see all the different aspects of your life and we’re able to take that now and have a better tax result.

In any given year we’re not trying to save as much as we can in this year. It’s looking at an entire lifetime left that gives us an opportunity to say where should we pay taxes early on, later, in the middle somewhere, should we spread them out evenly. Should I take on some tax liability so that my children can then have an inheritance tax-free? Should I pass that on to them because their tax rates are actually lower will be lower than mine?

It’s kind of looking at all those different options and it gives us an opportunity to do that tax plan.

So in summary, the Perennial Income Model helps us to avoid the tax land mines that might come up and helps us look for special tax opportunities that we have really that are specific to retirees.

The Perennial Income Model in Review (1:00:09)

Scott Peterson: Hey Jeff, thank you. Thank all of you for your help. You know, I just want to tell you all of you that are listening today, and some of you are here listening from other states I understand. But our office is kind of situated between UVU and BYU.

And I think Utah Valley University has one of the best financial planning programs in the nation. And of course, you have BYU with a wealth of talent and great people there too.

So whenever we need new advisors, I have the opportunity to get on the phone and we call some of the professors and tell them that we want the best and the brightest, and anyway, that’s where these advisors that you’ve been listening to come from.

I think they’re the very best and I’m so pleased that they’re working with me in our company.

Hey Josh mentioned something earlier on, he said, you know back in 2007, the Perennial Income Model was born but it was, think with me, it was immediately tested in ’08 and ’09.

And what really kind of launched it I think is that time period because we recognized that, you know, and by the way, we’d only had about half of our clients we’d been able to convert over to the Perennial Income Model simply because of time.

And we noticed that those who had the Perennial Income Model did so much better than those that didn’t. And really, it’s because they had a plan to follow, they weren’t as anxious, they understood. So after 2008-2009, we decided that that’s the only way we’re going to manage money for our clients going forward.

So again, we’ve been through several corrections now, it works great, and we’ve been able to refine it and make it better as the years go on.

So in summary, we’ll be done with this in just a minute, I just want you to think with me that, the Perennial Income Model is goal specific. So it matches your current investments with your future income needs. You know what you own, you know why you own it, and you know when it will be needed for your future income.

It creates a framework for investing. Because you have a goal specific plan, you know specifically how you should be investing. You know exactly when you need to liquidate and when you need to turn your investments into income so you can invest with confidence.

We find that a plan is the antidote to panic. So a time-segmented plan aligned with the program to harvest gains reduces investment risk if the plan is followed. And I honestly don’t know how we would even go about determining how to invest a retiree’s money without having a plan like this.

The Perennial Income Model provides a framework for distributing. You will know how much you can and should be able to take out of your investments. But the plan not only helps with investment discipline, it also helps with distribution discipline.

It helps you to monitor your own behavior and allows you to spend with confidence.

The plan creates a framework to manage risk. You know your greatest short-term risk, again, is stock market volatility. Your greatest long-term risk is that of inflation.

So the time-segmented plan, the Perennial Income Model addresses both of these risks. So you’ll have less volatile investments to provide for immediate income needs and more aggressive higher earning investments to keep up with inflation over the long run.

And then the additional benefits that frankly we did not think of when we created the plan back in 2007, this works as Daniel talked about as a bad luck insurance policy

So some of you may be those people, or you know those people who have retired right before a financial crisis, right before a stock market crash. We found the Perennial Income Model is very helpful in helping you manage that, to navigate those dangerous waters.

But it also protects you from your older self, and it will leave your spouse with a plan to follow at death.

And Jeff just kind of stuck his toe in the water there when it comes to tax reduction strategies. There’s just so much that can be done so, much good that could be done from a planning perspective with the Perennial Income Model.

Anytime you map out your income over 30 years, you can easily identify things that could be done now to reduce your taxes today as well as, you know years, in advance.

So anyway, we wanted to introduce that to you and just remind you of the, I mean all these things combined together really help to protect our clients. And I think with it, protect our clients I think from maybe their biggest risk, themselves.

Okay, once you have a plan to follow and stick with it, you’ll do better than those that don’t. I just know that to be the case.

In 2007, we realized that we were giving something special when we kind of figured out the Perennial Income Model. And it has superseded every expectation and it has benefited now hundreds of retired families in ways that we could not have even imagined back then.

But it does all these things we talked about. It provides us framework for managing your finances throughout retirement. And anyway, I’m just thankful for it. I’m thankful for my advisors and for all of you that are clients.

And for those that aren’t clients, we’d love to introduce you in more depth to this. If you’re interested, please contact our office, get the book, and see if this makes sense to you.

Question and Answer (1:05:51)

Daniel Ruske: So Scott, we have a couple questions, are we ready for that?

Scott Peterson: Yeah, let’s do that.

Daniel Ruske: I’d love to do a few questions. And I guess we’ll do probably five or so minutes and then there’s a survey. And so we promise we won’t take too long if you don’t mind hanging in there and giving us some feedback on the presenters and also on what you might want to hear next time.

And so I’ll start with the questions for Scott you and Jeff. And I thought they were really good ones.

So the first one I have here is, let me find it again. Okay, after the first five years is over does the investment on the remaining segments change? For example, would the second segment be invested as Segment 1 was, or a more conservative investment? Reed would like to know that answer.

Scott Peterson: Jeff you want to answer it, or should I?

Jeff Lindsay: Sure, so after the first five years, it’s not necessarily based on the time as much as the harvesting that Scott was kind of talking about. So what we’re working towards is reaching those goals.

If you think back to the spreadsheet that we had up, those yellow boxes. Those are the goals we’re shooting for and we find that we actually hit those goals when the market is, you know, kind of hitting all-time highs which only makes sense.

But that’s the time when a lot of people are getting greedy and it’s also the time when we say, okay, we’ve hit our goal now we’re ready to become more conservative there even though it feels like no, I want to stay in the market at this point.

That’s the time to go ahead and get more conservative. Not necessarily at three years or five years or ten years, it’s when we hit our goals.

Scott Peterson: Yes, so I think the answer, yeah, let me add to that thank you Jeff. The answer is, you know, we have the programs that are developed to help us monitor our progress in every single segment.

And so we’re getting more conservative as we reach our goals whenever we reach those goals. Okay, and so it’s not just at the five-year mark, but we’re monitoring that every day. And our clients have access to seeing the same thing as far as how the different segments are progressing. I hope that answers the question.

Daniel Ruske: We’ve got a couple more here. Craig wants to know, how do you guys make money?

Scott Peterson: Right, I’ll take that. So we charge just a flat management fee that’s agreed upon right up front. So, you know exactly how much we will withdraw out of your account.

And this is going to be depending on the amount of money that we manage. It’s going to be in the probably one to one and a quarter percent range. Okay, and so that’s how it works out. But I want to reassure everybody, and I think this is very important for you to ask questions if you’re looking for an advisor, to ask this question.

Do you earn a commission? And the answer with us is no. I don’t even allow people to have licenses to earn commissions in our office. We’re strictly fee-based and so there will be this one percent or so fee that we’ll take out on an annual basis to manage your portfolios.

And I might add with all the tax planning we do, all the investment management we do following the Perennial Income Model, if we’re not one percent by all means if we’re not worth that then you should take your money someplace else or do it yourself. But I think we rarely lose a client because once they’re on board, they see the value that we offer.

Daniel Ruske: I’m going to do one more here, and then if more come through, I’ll let you know. But this question is, how often does your company review clients’ portfolios, and how often does the client need to meet with you to review the portfolios?

Scott Peterson: So here Jeff, I’ll jump on that one too if you don’t mind. We have a formal quarterly investment committee meeting, so that’s what we formally do. So we’re taking a look at every single investment within all the different portfolios that we manage.

But I might add, you say how often do we look at the portfolios? Well, because all of our clients have relatively the same portfolios, maybe they have a different mix, you know one’s maybe heavier on the equity side than the other.

But the portfolios we manage, we just say, how often we look at them. Well, we look at them every day because everybody has the same portfolios. That’s easy for us if we see something that’s not right within the portfolio.

If we need to make an adjustment then we can make an adjustment across the board for all of our clients at the same time. So I think we have a very efficient system of managing portfolios.

Jeff Lindsay: And if I can also just add quickly, we meet with our clients as often as they need to meet with us. It’s at least a couple of times a year, but that’s when we’re sitting down and looking at more planning opportunities and your particular situation about what’s going on.

The investments are being managed across the board in the background all the time. Yeah, kind of you like said.

Daniel Ruske: Awesome, yeah, I think the other questions I’ve typed out. So if you didn’t get your question answered, if there’s one you didn’t want to send in front of everybody, please email us and that’s all Scott.

Scott Peterson: Great, well let me just conclude that if you’re an existing client and you’d like to review your Perennial Income Model, please reach out to your advisors, or call the office.

And again, if you’re if you’d like to know more, please get the book and please maybe reach out to us. We’d love to maybe show this, show you how this could work in your behalf.

So anyway, thank you so much everybody for joining us today, and we look forward to talking to you all soon.